Guide

How to Find the Right Health Insurance for Living Abroad

A practical guide for anyone planning to live abroad

Planning to live abroad for an extended period – or already on your way? Then finding the right health insurance is something you shouldn't put off.

Sounds complicated? It's not – once you know what matters.

How Long Are You Staying?

This is the most important question. Because it determines which insurance options are even available to you.

| Duration | Insurance Type | What You Get | Cost approx. |

|---|---|---|---|

| Up to 8 weeks | Classic travel insurance | Emergency coverage | 30-100 EUR/year |

| 2-12 months | Long-term travel insurance | Includes planned treatments | 80-250 EUR/month |

| 1+ years | International health insurance | Full coverage like private insurance | 300-1,000 EUR/month |

Short trip: For a few weeks, basic travel insurance is usually enough. It's affordable and covers emergencies.

Several months: This is where it gets interesting. You need something that also covers planned treatments – not just emergencies. Medium-term plans are designed for this.

Long-term or permanent: For anyone staying longer than a year, there are proper international health insurance plans. They offer similar coverage to private insurance back home.

Your length of stay is the most important factor when choosing the right insurance

First, Check What You Already Have

Before signing up for anything new: look at what your current insurance already covers.

- Public health insurance in Europe: The EHIC works in EU countries for temporary stays – but only for public healthcare, no repatriation

- Private health insurance: Ask them – some extend international coverage for free or a small fee

In Europe, public health insurance can already protect you partially. And if you have private insurance, just ask. Some providers extend coverage abroad for an additional fee. Others already include it in their terms.

Important: The EHIC only works in the EU and doesn't cover medical repatriation. According to ADAC, repatriation from the USA costs around 60,000 EUR on average, up to 180,000 EUR for intensive care transports – public insurance won't pay for that.

What Do You Actually Need?

Here's a simple rule of thumb:

The fewer obligations and the more financial flexibility you have, the less comprehensive your coverage needs to be. You can pay for check-ups yourself sometimes.

But once family, children, or family planning come into play, things look different. Then a more comprehensive plan makes sense – one that covers things like orthodontics or prenatal care.

Required coverage varies based on your life situation

| Life Situation | Recommended Coverage | Priorities |

|---|---|---|

| Solo, young, healthy | Basic plan | Emergencies, medical repatriation |

| Couple without kids | Standard plan | + Preventive care, dental |

| Family with children | Premium plan | + Family coverage, childcare |

| Pre-existing conditions | Individual plan | Find specialized providers |

Four Things You Should Pay Attention To

- Be honest about pre-existing conditions – Fill out the application truthfully. Sounds obvious, but it's important. False information can lead to coverage gaps later – exactly when you need protection.

- Coverage should match your region – Some plans only apply in certain regions. Check that the countries you're actually staying in are covered – even if you come home in between.

- Choose a reliable partner – An insurer that's reachable and responds quickly makes a big difference in emergencies. Good service is not a nice-to-have.

- Get expert advice – A broker who specializes in international insurance can save you a lot of time and stress. They know the details and have good contacts with providers.

Don't Compare Apples and Oranges

A common mistake: comparing plans that aren't really comparable. A cheap plan with a high deductible looks attractive at first – until you realize what it doesn't cover.

Read the fine print. Or have someone who knows their stuff explain it to you.

What to look for when comparing:

| Criteria | Why It Matters |

|---|---|

| Medical repatriation | Should ALWAYS be included – can otherwise cost up to 180,000 EUR |

| Coverage area | With or without USA/Canada? North America plans cost significantly more |

| Dental treatment | Often just emergencies covered, rarely preventive |

| Pre-existing conditions | How are existing conditions handled? |

| Cancellation terms | Flexibility when plans change |

When comparing, focus on actual benefits, not just the price

Our Recommendation

Get an initial overview online – but don't make a final decision without talking to an expert. Every situation is different, and in the end, it's the details that matter.

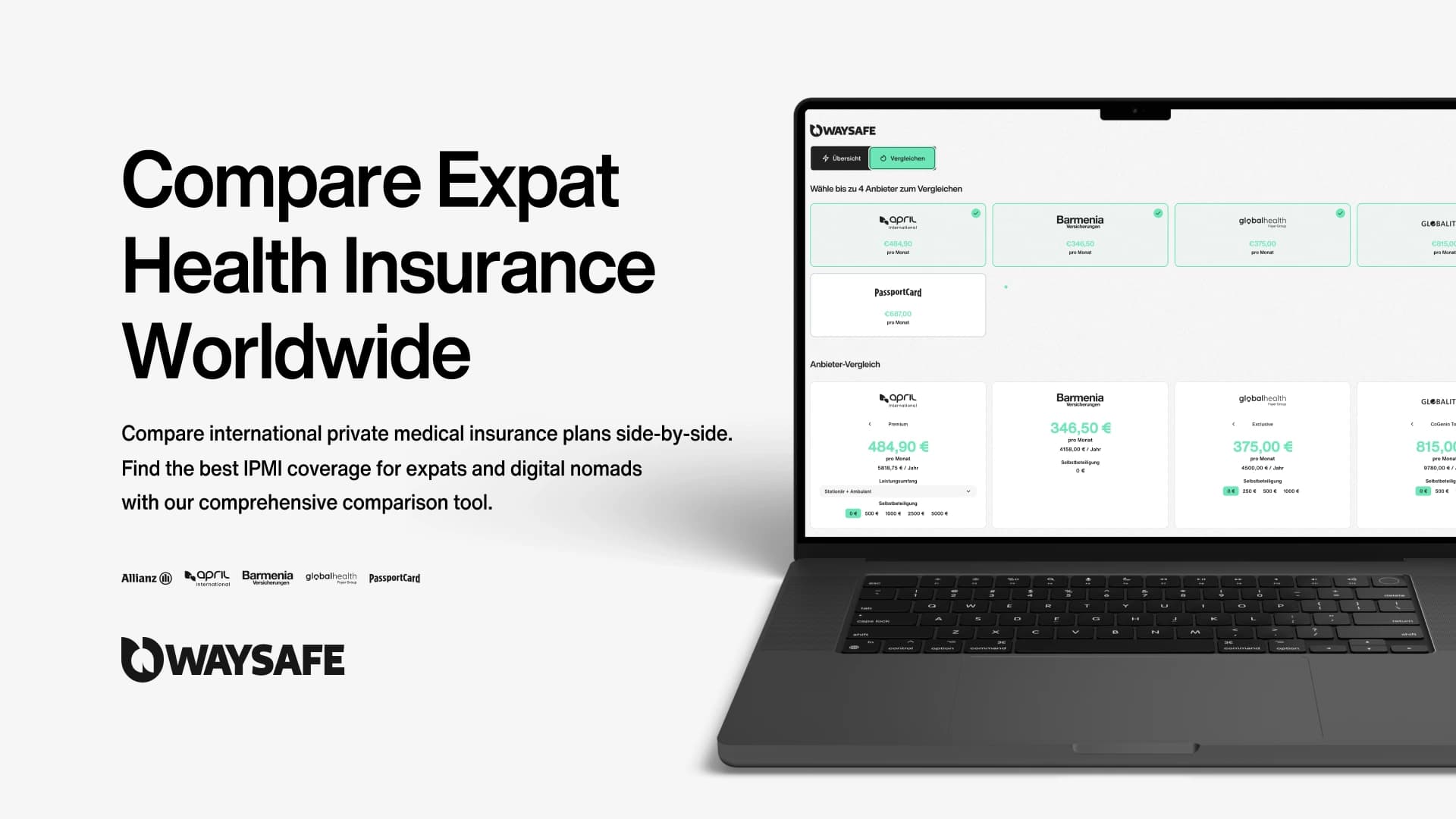

Find Your Perfect International Health Insurance

Compare plans from leading providers in 2 minutes – free and non-binding

Have questions? We're happy to help you find the right solution.